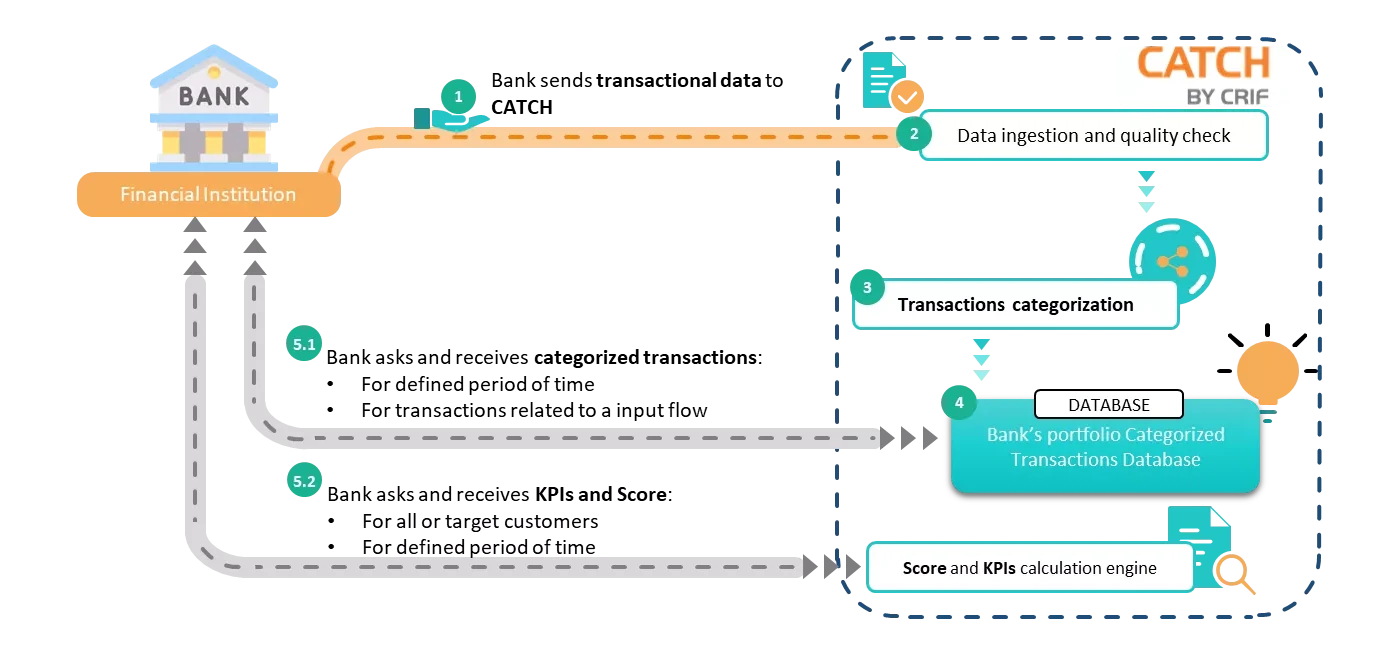

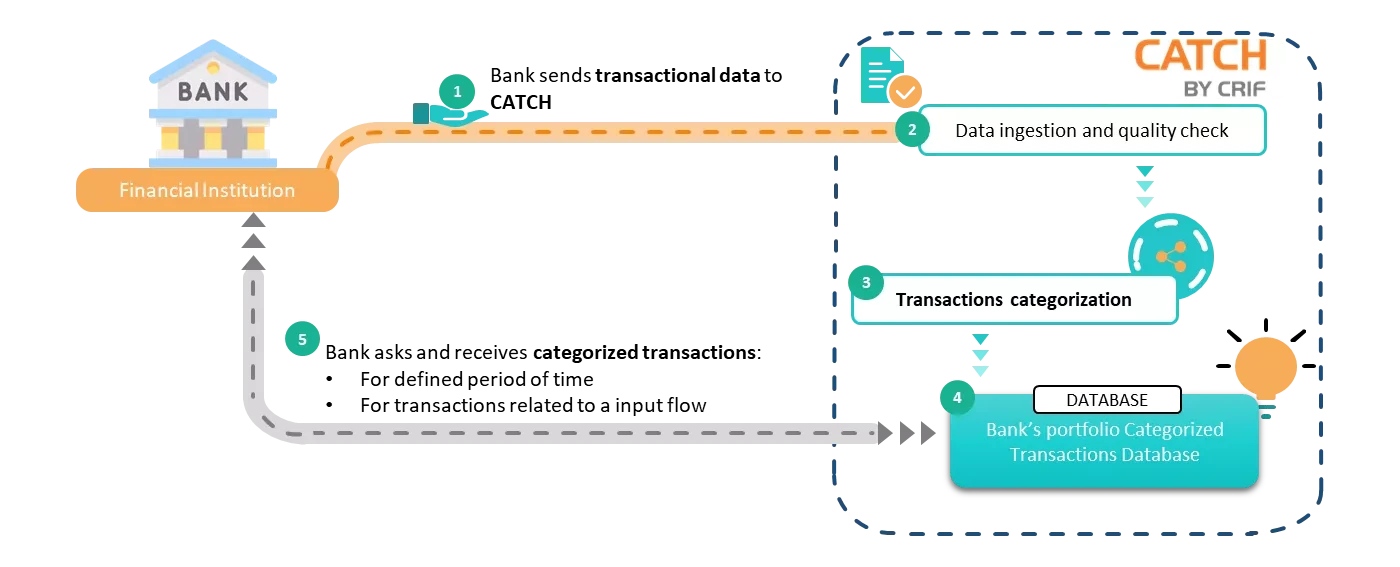

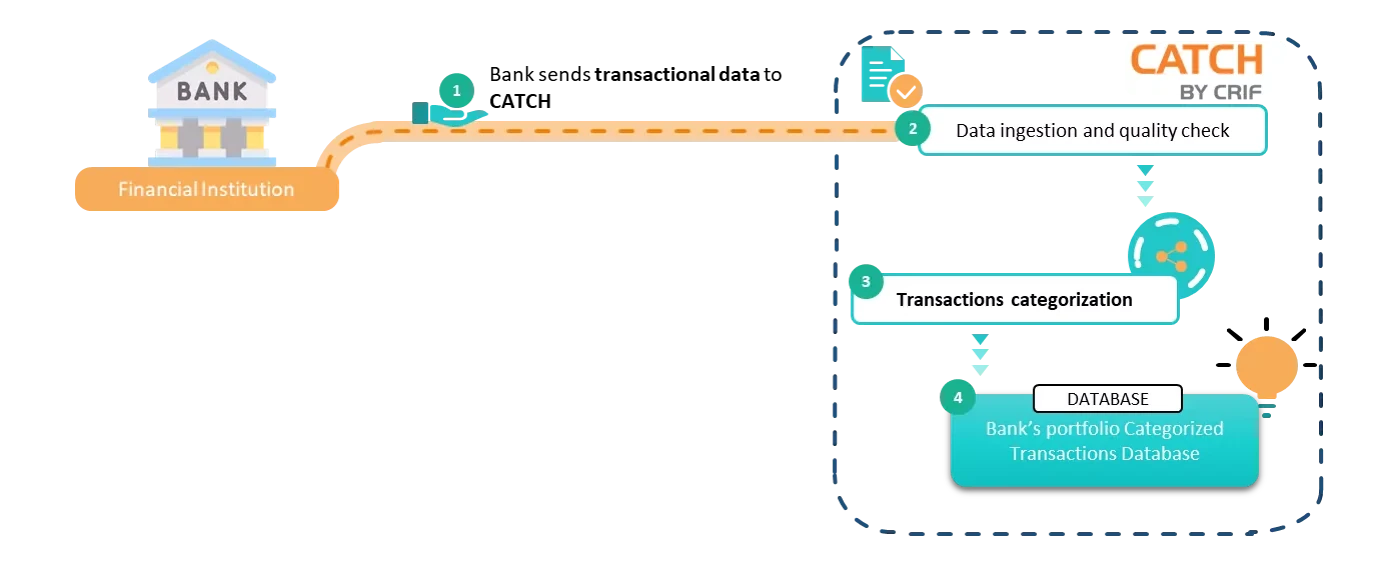

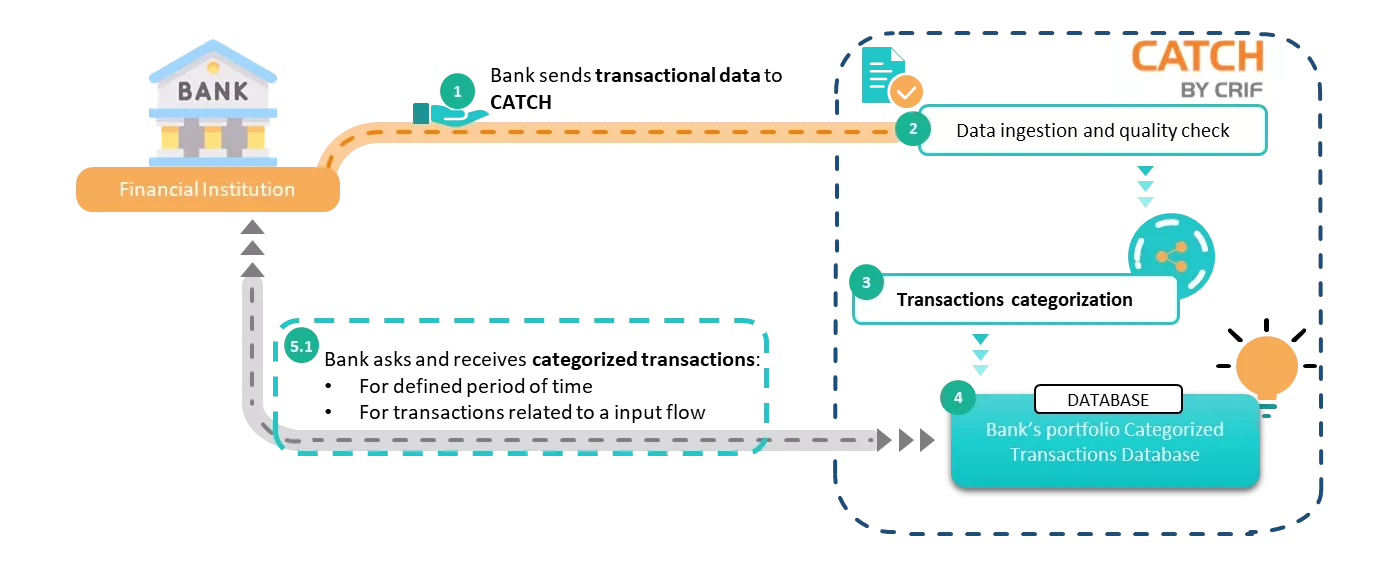

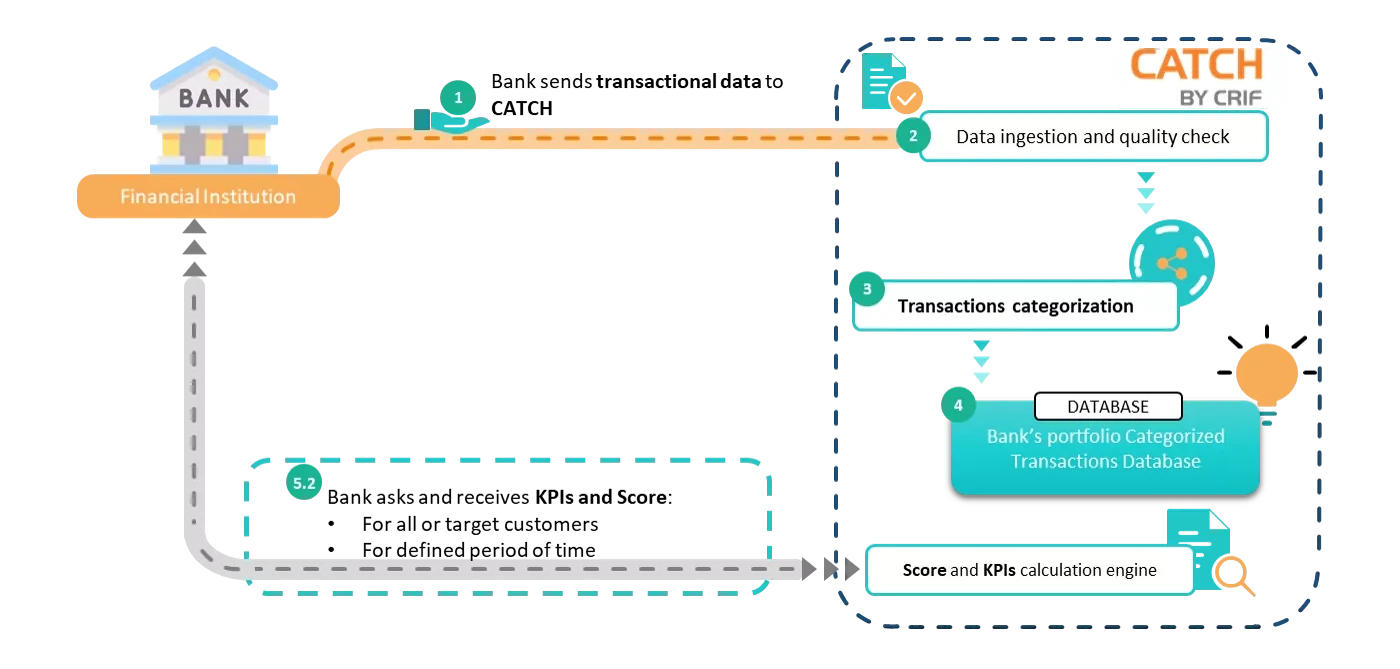

CATCH is a solution targeted at financial institutions (e.g. Banks) willing to exploit the value of transactional data (e.g. current account data or credit card data) on their own customer base.

Starting from current account data of the Bank, CATCH enriches Bank customer base with:

- List of categorized transactions

- Risk KPIs allowing to monitor customer credit worthiness

- Cross-Up Selling KPIs to analyze behaviors and preferences to run appropriate commercial actions

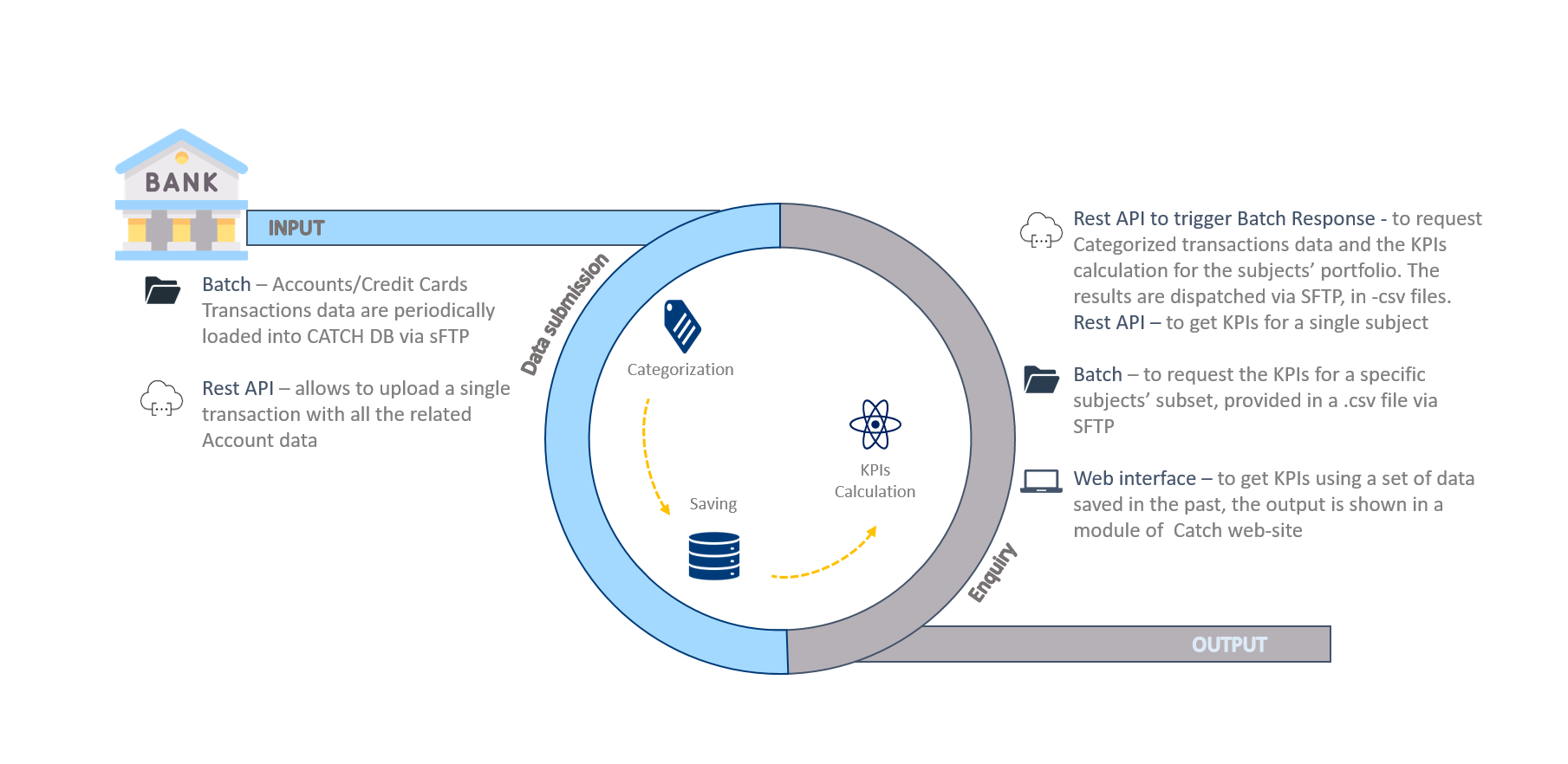

The main inputs of CATCH are current/credit cards account data provided via batch by the Bank.

Transactions are classified by CRIF Categorization engine and the Score Engine allows the execution of algorithms to calculate the KPIs.

The output is a set of predefined Risk and Cross-Up Selling KPIs (to select the eligible customers for proactive upselling), as well as the list of categorized transactions. CATCH allows also to deploy and execute Custom KPIs according to Client’s business priorities.

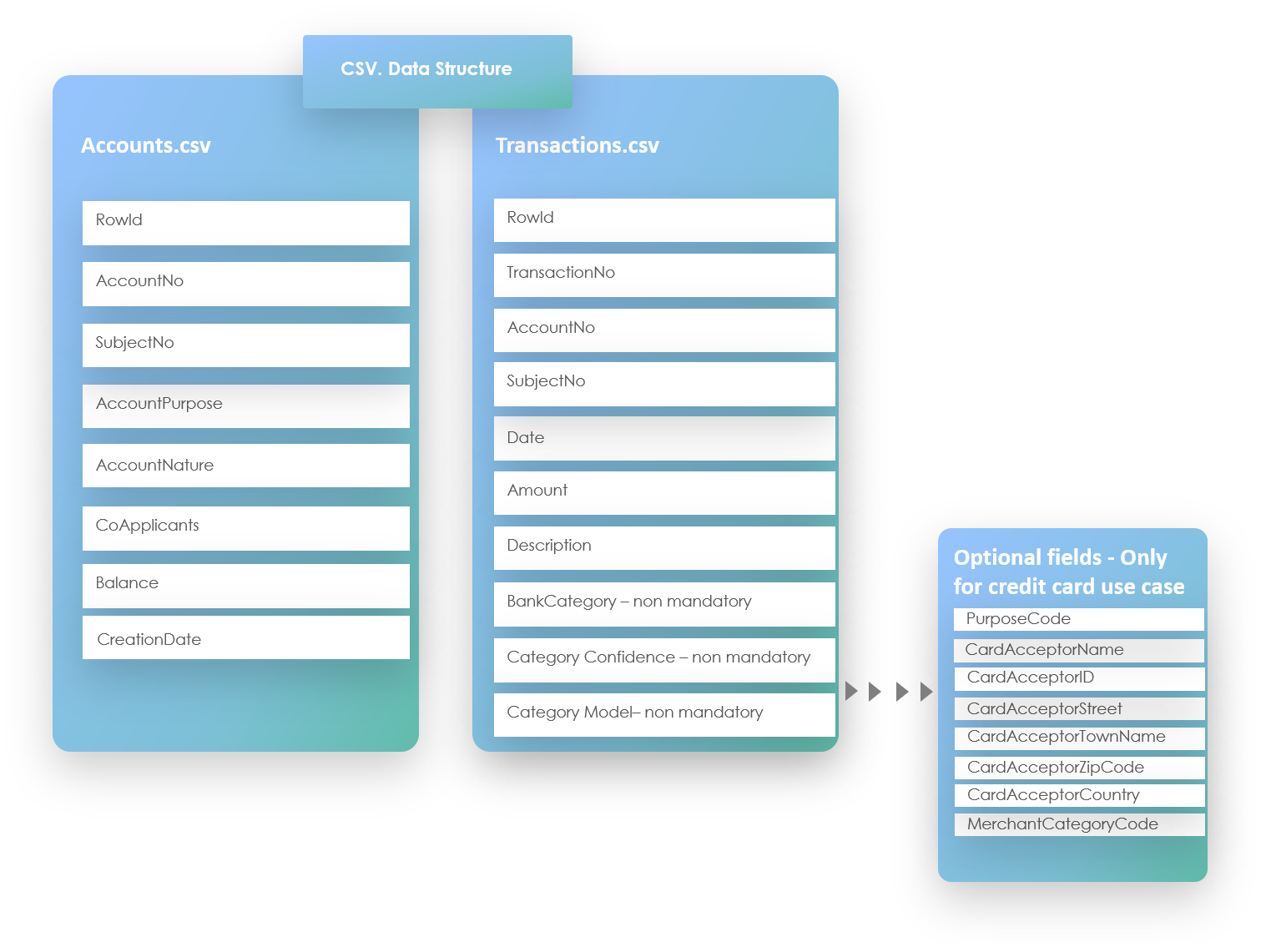

The bank feeds CATCH mainly via batch, transferring input CSV files via sFTP protocol.

Current account data are mandatory, credit cards one are optional, and shared through two input files (accounts.csv, transactions.csv) with a fixed record structure.

It is also possible to submit an optional input file with a set of data related to the Subjects (subject.csv).

The frequency of the data submission is not fixed, but based on the needs of the bank.

On top the bulk batch feeding a single-transaction input via API is supported, to enable specific near real-time use cases.

CATCH classifies every input transaction using the CRIF categorization tool. With this operation a specific category is assigned to each transaction.

Data are saved in the proprietary Database, together with the related category, building the suitable historical depth of transactions of each account that enables the Bank to retrieve two different types of output:

- List of categorized transactions

- KPIs and Scores calculated on the full or partial bank Portfolio

Categorized transactions can be retrieved through a batch process triggered by two JSON/REST APIs (GTD-GTF). Result is provided as csv file returned into the sFTP folder; with such two JSON/REST APIs Bank can filter and configure the output.

KPIs and Scores can be retrieved through different mechanisms:

- a batch process triggered by a JSON/REST API that performs the KPIs calculation and returns the file, in the sFTP folder, with the KPIs for each subject (GKP-GKU)

- the JSON/REST API that returns the single subject’s KPIs directly in the API response (GKS)

- the BATCH process called GKL, that calculates and returns the KPIs for the list of subjects provided in a specific .csv input file. This function will not be detailed here, for further information please check the User Manual chapter 3.3 (download available in Quick start paragraph)

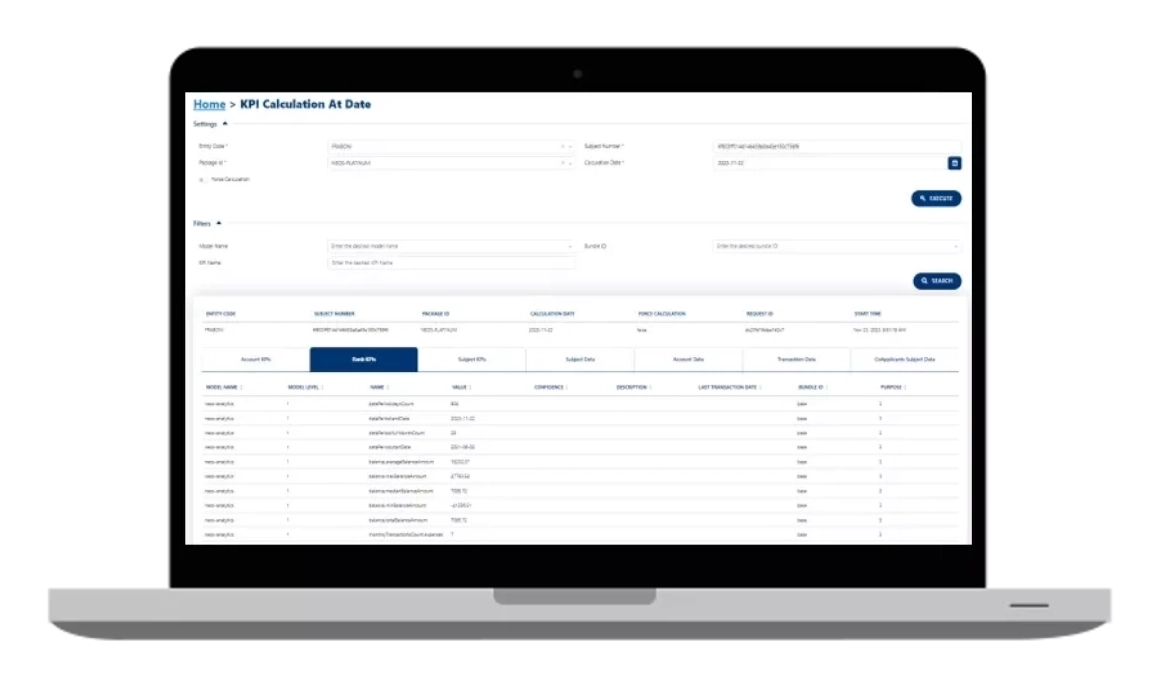

- the KPIs Calculation at the Date (KCD), a function exposed into CATCH web-site, that enables the Bank to calculate KPIs using historical data saved in the DB. The output is a visual set of tables with both KPIs and the data used for the calculation

Moreover, Catch exposes two APIs to check the status of the functions in the system, giving the Bank full control of the system.

Glossary

- Financial institutions: The target of CATCH system, all the institutions that own accounts and or cards transactional data, in this page we will use Bank as a synonym

- Subject: A Bank account holder

- Account: A current account or a credit account

- Transaction: Each account transaction composed by amount, description, date and sign

- Classifier: CRIF proprietary categorization algorithm, which allows to classify current account transactions assigning to them a category

- Category: Information assigned to each saving/spending transaction that classifies it

- KPIs and scores: All the calculated variables, indicators and predictive score that can be calculated upon CATCH input data

- Package: KPIs and score are collected in packages. Banks can activate one or more KPIs and score packages to be applied to his Portfolio

- User: Application User that interacts with Batch and API protocols

This API supports the following grant types

- Password

To call this API, you must get the token with one of the supported grant types listed above.

For more information about how to get the token with different grant types, see our start guide for developers.

To see the client ID and the client secret you can use, login and go to your profile, and see the Application section.