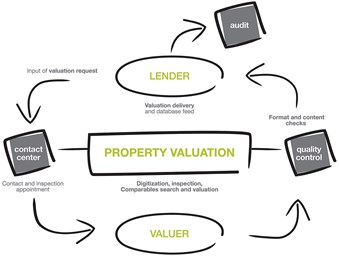

All elements are integrated into a structured workflow, making sure that all valuations are in line with the relevant standards. The entire process is constantly and closely monitored to guarantee the quality and value of the output. The workflow can be integrated into the operating and IT structure of the bank or financial institution, thus keeping organizational impacts to a minimum. The entire process can be outsourced to CRIF Property Valuation, reducing both management time and costs.

Main Advantages

CRIF RES at a Glance

Property Comparables Database of +1,3 MLN data

A nationwide network of qualified, independent valuers

Compliance with international valuation standards

Structured and integrated workflow

CRIF Property Valuation Workflow

RequestCRIF receives a request from the Lender |

|

AuditIf required, CRIF can perform second level controls on the Reports, through the Audit office |

Contact CenterCRIF contacts the client in order to arrange the property inspection |

DeliveryThe Final Report is delivered to the Lender |

|

InspectionThe valuer performs an internal and external inspection of the property |

Quality ControlThe Report is submitted to the Quality Control office to ensure that the format and content are correct and compliant with CRIF quality standards |

|

Property Valuation ReportThe Property Valuation Report drafted by the valuer contains the real market value of the property |

A new efficient valuation process with PRISMA |

|

|

|

Prisma

PRISMA APIs provide access to Property Valuation services, allowing CRIF clients to request, monitor and retrieve property valuations for different types of properties.